Renters Insurance in and around San Jose

Renters of San Jose, State Farm can cover you

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Calling All San Jose Renters!

Your rented apartment is home. Since that is where you rest and spend time with your loved ones, it can be beneficial to make sure you have renters insurance, whether or not your landlord requires it. Even for stuff like your tools, kitchen utensils, video games, etc., choosing the right coverage can help protect your belongings.

Renters of San Jose, State Farm can cover you

Coverage for what's yours, in your rented home

Renters Insurance You Can Count On

It's likely that your landlord's insurance only covers the structure of the townhome or apartment you're renting. So, if you want to protect your valuables - such as a cooking set, a stereo or a microwave - renters insurance is what you're looking for. State Farm agent Derek Alota is passionate about helping you examine your needs and insure your precious valuables.

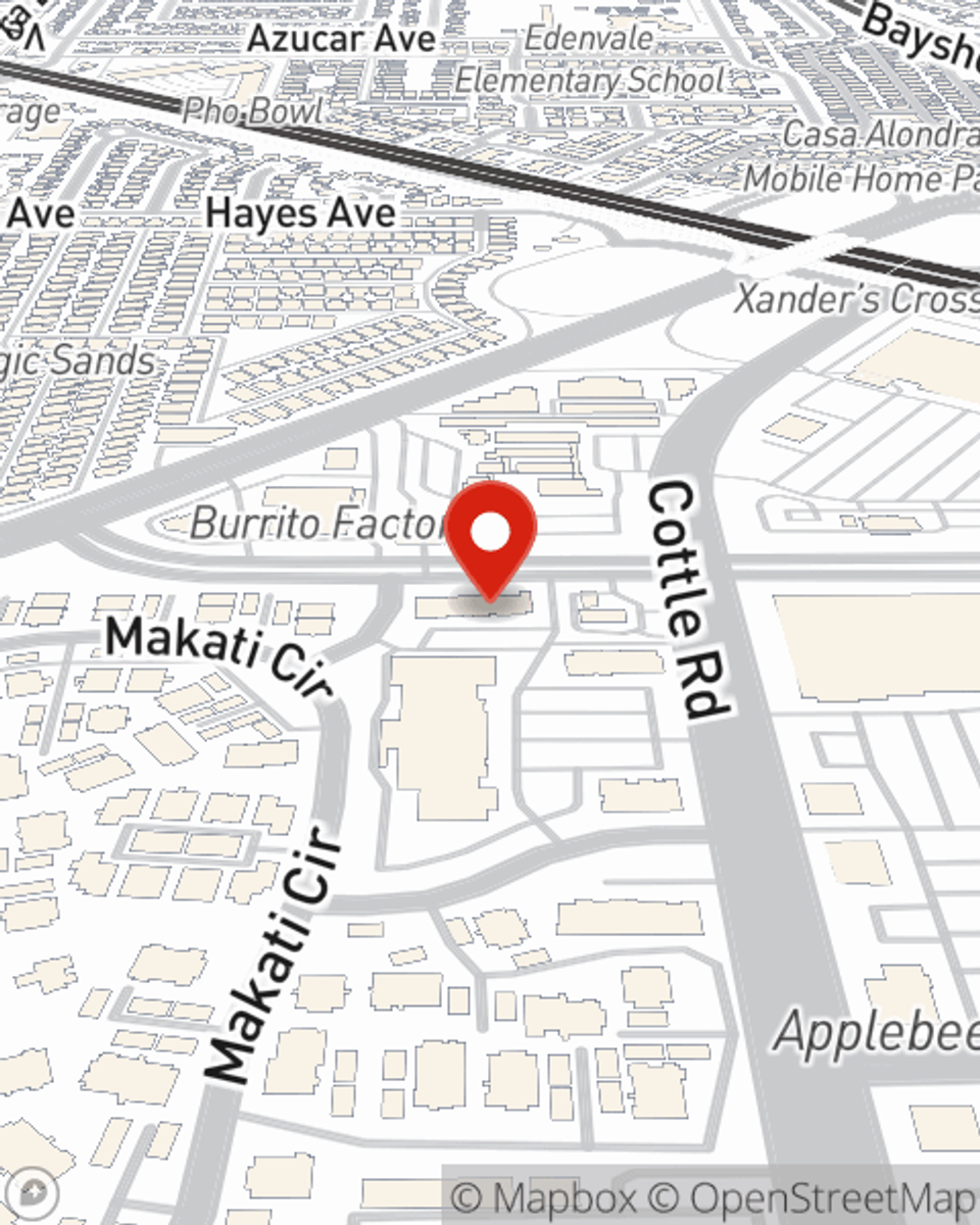

A good next step when renting a residence in San Jose, CA is to make sure that you're properly insured. That's why you should consider renters coverage options from State Farm! Call or go online now and find out how State Farm agent Derek Alota can help you.

Have More Questions About Renters Insurance?

Call Derek at (408) 620-1690 or visit our FAQ page.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Derek Alota

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.